Charitable Planning

Tax-Advantaged Giving Strategies

Our team of nonprofit attorneys is proud to have structured over $100 million in sophisticated charitable gifts for our clients. And our managing attorney, Yaser Ali, is proud to be the executive director of a nonprofit scholarship foundation that supports the education of local Arizona children.

Designing charitable donations in your estate plan

No matter what assets you have, we can ensure they support the people, organizations, and causes you care about most.

There’s nothing more fulfilling than knowing you are able to help others. Our attorneys possess a deep understanding of the charitable gift planning process. We work closely with your CPA and other advisors to structure transactions that meet your philanthropic goals. Whether you’re interested in doing so for religious or other personal motivations, we can help shape your legacy by incorporating charitable bequests in your estate plan or naming a charity or nonprofit as a beneficiary.

Optimizing tax burdens through charitable giving

Paying taxes is a responsibility, but you’re under no civic obligation to pay more than your fair share. Our array of advanced charitable tax planning tools can yield significant tax savings while supporting the causes and organizations you’re most passionate about.

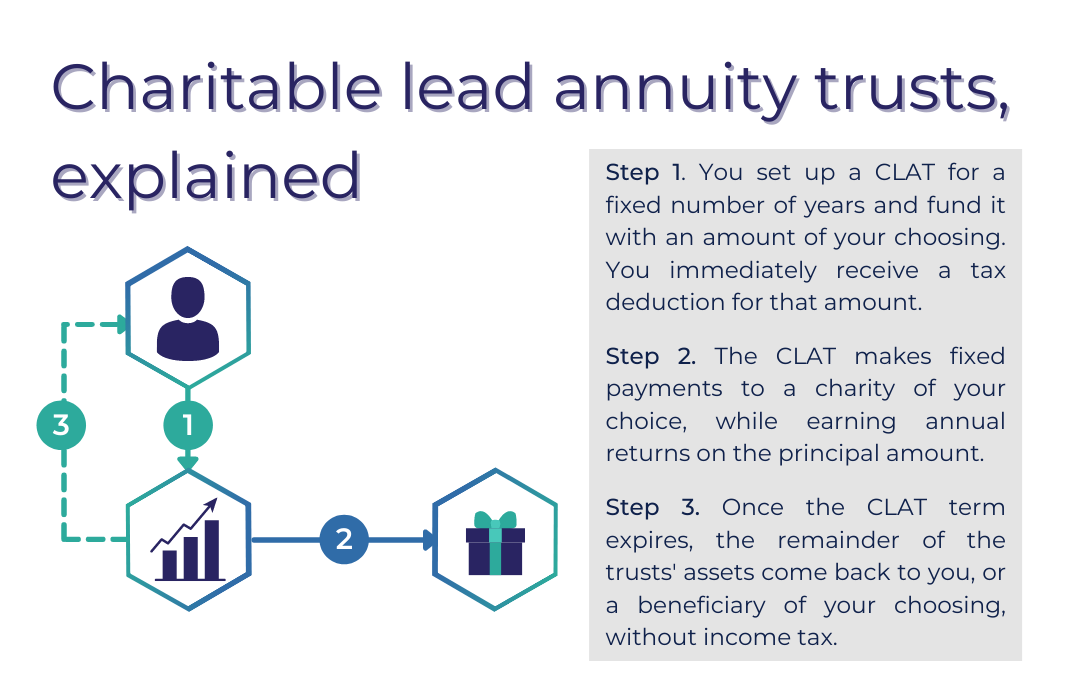

We have extensive experience drafting customized charitable lead annuity trusts (CLATs), charitable remainder annuity trusts (CRATs), and charitable remainder unitrusts (CRUTs). These split-interest trusts can provide powerful immediate tax savings to you, income streams to your family, and a lasting impact to your community.

Creating your own non-profit

Creating a nonprofit can look similar to starting a new for-profit business — but with added complexity. Both kinds of projects carry a variety of pressing legal needs, but nonprofits are also subject to specialized rules, requirements, and IRS regulations.

In short, the setup and management of a nonprofit can be enormously rewarding, but technically daunting. And, when embarking in a project of this significance, it’s good to know you’re in good hands.

If you’d like to set up an nonprofit organization — like a school, religious institution, international charity, or community organization — we can help. Our team will be at your side throughout the project’s duration, from the planning to the maintenance of a nonprofit organization.