CUSTOMIZED ESTATE PLANNING SERVICES

Law can be complicated and confusing. Families are often complex and dynamic. But estate planning has always been a constant.

It’s actually one of the oldest and most traditional legal exercises, dating back thousands of years across cultures and civilizations. When done correctly, estate planning is a deeply contemplative process that requires a person to confront their own mortality, analyze their life, and design their unique legacy.

The job of an effective estate planning attorney isn’t just to transcribe these wishes. It’s to work closely with the client to counsel them through the process and carefully design a plan that memorializes their individual convictions, hopes, and concerns into legally enforceable instruments.

That’s where we come in.

Our experienced team of Phoenix, AZ estate planning attorneys are skilled in navigating the complicated state and federal tax laws and understanding the many family and personal issues related to this practice area. We assist our clients around the country in protecting, managing, and transferring their wealth. Our attorneys frequently speak at conferences and write extensively on a wide array of estate planning topics.

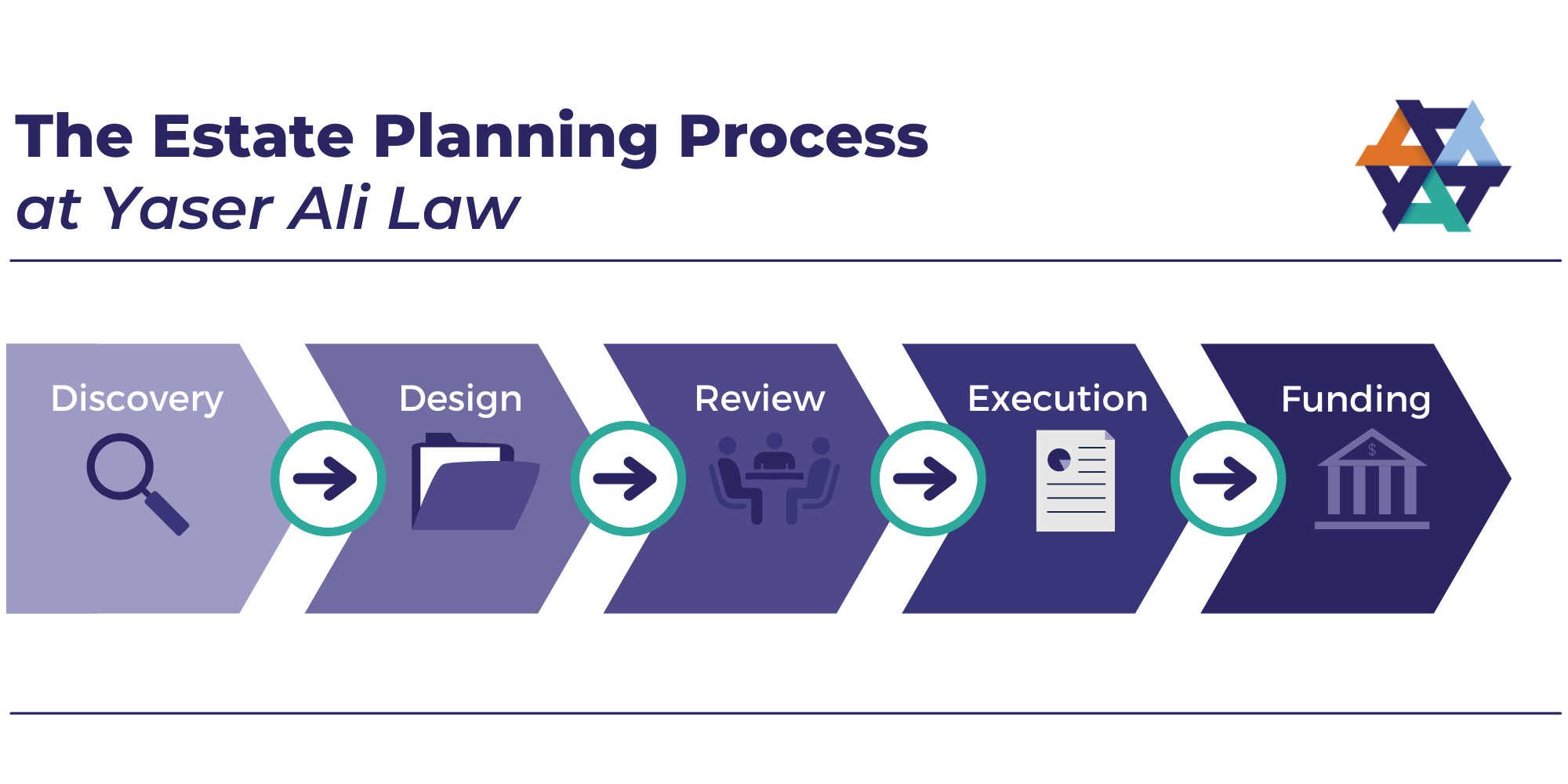

We’ll devise and explain a plan that will provide the legal protection you’re looking for, and introduce you to the legacy-planning tools and strategies that your family can use to accomplish your priorities. We’ll provide you with a specific fee quote to draft and implement your plan – and when you’re ready to move forward, we’ll ask for a deposit so that our team can get to work for you.

Of course, at any point during this stage, you’re welcome to modify the direction of your plan, and we’ll be glad to discuss integrating any new ideas or priorities into your plan. Once we’re on the same page about what your plan should look like, our experienced team of estate planning specialists will get to work.

We’ll also send you copies of your documents at this time, for your review. You’re welcome to take some time to review them with your loved ones, and ensure that everyone named in your estate plan understands their role in carrying out your wishes.

If you’re one of our clients from outside the area, or out-of-state, that’s not a problem – we’ll provide comprehensive signing instructions and send you a binder containing your documents by mail, so that they can be executed and notarized wherever you are.

We understand your financial situation will change over time, and if you ever need assistance transferring assets into an entity that’s in your name, our team can help you prepare and execute documentation that achieves this. We’ll always be just a phone call or an email away from getting you connected with your problem-solving legal team.

Our comprehensive estate and tax planning strategies often include the following components:

Revocable living trusts

Certification of trust

Last will and testament

If a revocable living trust isn’t for you, we can still help – a customized last will and testament can provide some useful guidance to direct your successors about your wishes regarding your assets. This is effective upon death and subject to the probate process; learn more about Arizona probates here.

Power of attorney

Healthcare directive

Charitable trusts

Dynasty trusts

Building up generational wealth can be difficult with estate and transfer taxes. A dynasty trust minimizes your tax burden by creating a multi-generational trust with distributions planned out to beneficiaries of each generation. As long as assets remain in the trust, they wouldn’t incur gift, estate, or generation-skipping transfer taxes.

Intentionally defective grantor trusts (IDGTs)

Intentionally defective grantor trusts, or IDGTs, are a form of advanced tax planning that higher net-worth clients may use to their advantage. Assets are placed into a trust with beneficiaries listed, but the trust is intentionally written to have the grantor still liable for income tax purposes. The grantor pays gift tax on this transfer, and income taxes on the increase of the value of trust assets. However, as the trust value grows, it is frozen for estate tax calculation purposes; this can singificantly minimize your tax burden.

Spousal lifetime access trusts (SLATs)

A SLAT, or spousal lifetime access trust, is a kind of irrevocable trust (meaning it can’t be revoked, or undone). This is often used as a gift to transfer wealth outside of an estate; when the federal gift and estate tax exclusion is used, the gift to the trust is not taxable. This allows the donor spouse (the creator of the trust) to create a lifetime gift that evades gift and estate taxation, while reducing the size of their estate.

Beneficiary defective trusts (BDTs)

Using a beneficiary defective trust (BDT), also known as a beneficiary defective inheritor’s trust (BDIT) is another powerful tax planning tool you can use. Essentially, we’d create a trust that holds your assets while allowing you to control and utilize them – and this trust would be “intentionally defective,” creating a freeze of the asset’s value at the date of contribution. When you’d like to plan a significant gift and ensure your hard-earned wealth goes to your heirs while optimizing your tax burden, a BDT can be an effective strategy.

Family limited partnerships (FLPs)

A family limited partnership, or an FLP, is a project in which members of a family pool money to run and operate a business project. You can gift FLP interests tax-free every year, which means that making family members limited partners can benefit them by providing a regular source of income.

Intra-family gifts, sales, and notes

Depending on your assets, goals, and interests, gifting assets and other property to family members can be done in a number of ways. Beyond some of the strategies discussed on this page, you may make a gift through its incorporation into a revocable living trust, or through a loan in exchange for a promissory note. Gifting can create taxable events, and these strategies will all have nuanced tax benefits and consequences. Call us today to learn how we can help you make a gift to a family member.

Family foundations

A family foundation is a type of nonprofit corporation set up by members of one family. If you’re interested in generating tax-deductible donations while encouraging your family to donate for generations to come, we can help you set up a 501(c)(3) or equivalent organization, prepare any necessary documentation you’ll need, and advocate for your interests to the IRS.